The RP-Sanjiv Goenka Group (RPSG) recently experienced a meteoric rise in net worth, adding a staggering ₹16,000 crore in a single month. This dramatic increase necessitates a comprehensive analysis of the underlying factors, future prospects, and inherent risks. What fueled this impressive growth, and is it sustainable? To learn more about Sanjiv Goenka's personal wealth, see his net worth here.

Unpacking the ₹16,000 Crore Surge: A Deep Dive

This substantial increase in net worth stems from a confluence of factors: exceptional performance from key subsidiaries, a strategically implemented five-year plan, and calculated diversification efforts.

High-Performing Subsidiaries: Driving the Growth

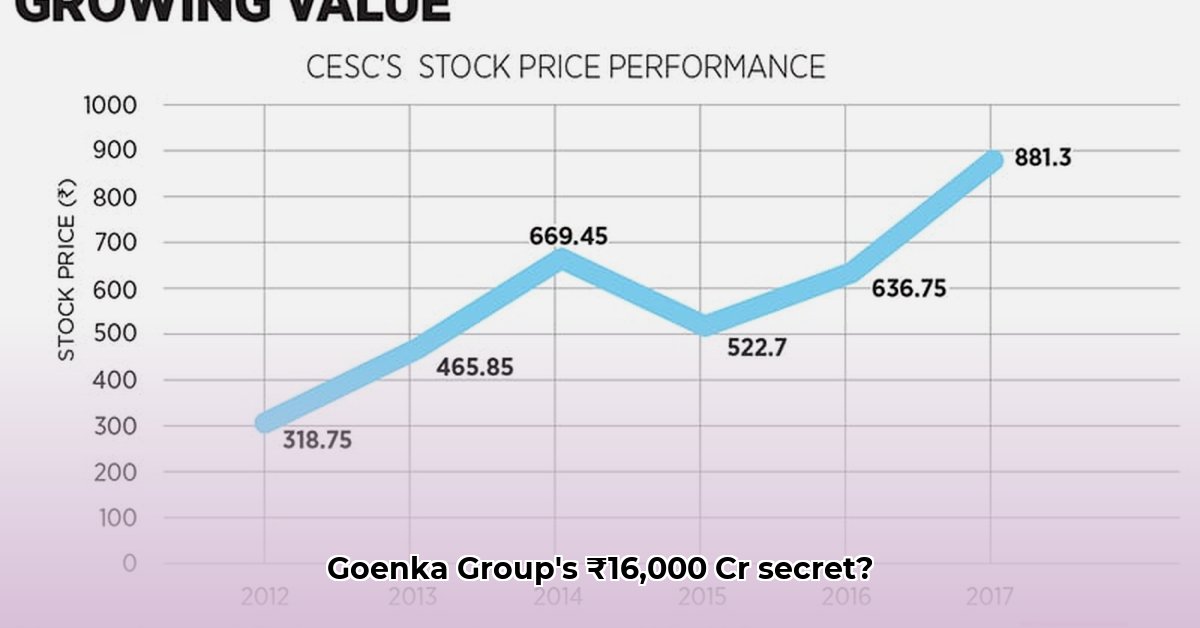

Two subsidiaries, in particular, deserve significant credit for this surge. PCBL (Phillips Carbon Black Ltd.), a producer of specialty carbon black, witnessed a remarkable 183% year-over-year return. This extraordinary performance is primarily attributed to strong demand for specialty carbon black and successful market expansion. Similarly, CESC (The Calcutta Electric Supply Corporation) achieved a 138% year-over-year return, demonstrating improved operational efficiency and increased electricity demand—a key factor in understanding RPSG's rapid financial growth. While Firstsource, their business process outsourcing arm, also contributed, precise figures aren't publicly available at present. These results highlight the underlying strength and efficiency of RPSG's operational strategies. How long can this momentum continue? A careful watch on their capacity to meet future demand is paramount.

The Sanjiv Goenka Five-Year Plan: A Roadmap for Success

Sanjiv Goenka's ambitious five-year plan, initially perceived as ambitious, is now proving remarkably effective. This plan, along with significant projected capital expenditure (₹35,000 crore in the near term and ₹50,000 crore over the next three years), has significantly boosted investor confidence. The clear trajectory and commitment to expansion outlined in this plan are key drivers for the group's valuation.

Diversification: Strategic Risk Mitigation and New Avenues

RPSG's diversification strategy extends beyond its core businesses. Their investment in the Lucknow Super Giants, an Indian Premier League (IPL) franchise, while seemingly unrelated, has enhanced brand visibility and created a new revenue stream. This investment showcases a smart approach to risk management and brand building. Can this diversification continue to deliver strong financial results? Further success in IPL and ventures in other diversified areas will be crucial for continued expansion.

Analyzing Long-Term Sustainability

While the current growth is impressive, maintaining this trajectory requires careful consideration of potential risks and uncertainties. Market fluctuations, increasing competition, and regulatory changes pose significant challenges. Continued operational excellence, adaptability to changing market dynamics, and effective risk management are crucial for sustained growth. The Lucknow Super Giants investment, although beneficial for brand building, needs continued assessment for its long-term financial contribution.

Risk Assessment

Several factors could influence the future trajectory of RPSG. Market fluctuations, competitive pressures, and regulatory changes all present potential challenges. Maintaining the current growth rate necessitates ongoing operational efficiency, adaptation to market shifts, and vigilant risk management.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Regulatory Changes (Power Sector) | Medium | High | Diversification, engagement with regulators |

| Market Volatility | High | Medium | Robust financial planning, strategic hedging |

| Increased Competition | High | Medium | Continuous innovation, strategic partnerships |

Conclusion

The Goenka Group’s recent growth showcases impressive strategic planning, subsidiary performance, and diversification. However, the long-term sustainability of this success hinges on ongoing adaptation to market conditions, meticulous risk management, and the continued success of diversification strategies across different sectors. The current trajectory is positive, but continued vigilance is required to navigate inherent risks associated with rapid expansion.